What is Microfinance?

Microfinance generally refers to the provision of basic financial services such as loans, saving accounts and insurances for low-income but economical active people. In most instances the term microfinance refers to the provision of small loans (=micro credits) for micro-entrepreneurs.

The UN believes microfinance to play a central role in the battle against poverty and proclaimed the year 2005 as the “International Year of Microcredit”.

The idea of microfinance, however, is not new but can be traced back to the principle of self-help and solidarity which was devised by savings banks and cooperative banking groups (e.g. Raiffeisen) 150 years ago.

In the 70s Muhammad Yunus, professor of economics, began to hand out small loans in his home country Bangladesh. He founded the Grameen Bank in 1983 which today is active in over 70,000 villages in Bangladesh. The Grameen Bank employs 25,000 people and has 7.4 m borrowers, 97 % of which are women. Muhammad Yunus was awarded the 2006 Nobel Peace Prize. His concept is employed in 60 developing countries today.

„All that is necessary to save the poor from poverty is to create a functioning environment. Once the poor can unleash their energy and creativity poverty will vanish quickly”. (Muhammad Yunus, professor of economics, Grameen Bank, Lecture at the Nobel Peace Prize award, Oslo, 10 December 2006)

Microfinance Institutions

Your investment in Vision Microfinance enables the provision of small loans to low-income people via carefully selected microfinance institutions (MFIs).

A Microfinance Institution (MFI) is an organisation that provides financial services for MSME - Micro- Small and Medium Enterprises. They are mainly present in developing countries and vary in size and scope. They often start up as non-government organizations (NGOs) which concentrate merely on loans and later turn into regular banks which offer all common financial services.

The lack of „traditional“ collateral of micro-entrepreneurs is compensated by a thorough check of the personal living circumstances and a close contact between the microfinance institution and the micro entrepreneur. Microfinance institutions know their clients intimately, they meet regularly and help and advise them.

Often microfinance institutions give loans to small groups of people who are jointly liable for the timely payment of the debt. The social network is often very strong in developing countries; it ensures that everybody wants to pay back the loan to save face. The payback ratio of micro-entrepreneurs to microfinance institutions is an impressive 95-98%.

Micro Credits

Micro credits are small loans with a big effect. They are based on the principle of trust and personal responsibility. To believe in people in turn strengthens their self-esteem.

However, micro credits are no charity. They have to be paid back in time and interest is charged. They are characterised by:

- Small credit sizes.

- Short maturities.

- Amortization of principal and interest rate in many small installments.

- Personal relationship between the microfinance institution and the client with frequent personal visits.

- Detailed knowledge of the living circumstances of clients as a replacement for collateral.

- Micro credits are an incitement for economy.

- Money does not dissipate but work.

- Money is paid back and handed out again.

- This dynamic cycle enables more and more people to escape.

Social Benefit

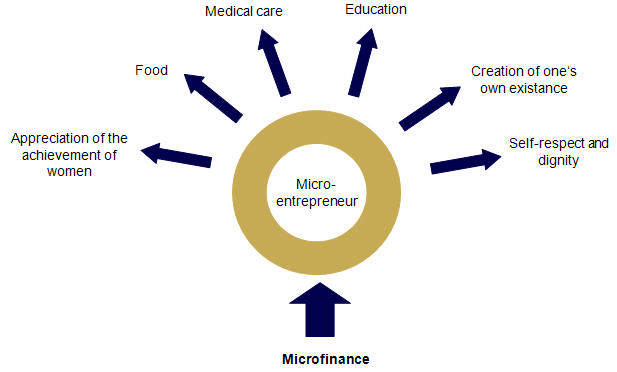

Microfinance improves the quality of life of families in the poorest countries in a sustainable way. Microfinance gives poor people the opportunity to establish an existence and to create a future with prospects.

Microfinance permits an increasing number of families access to food, to medical care and to education for their children – now also for their daughters. Consequently, microfinance has an impact on the future generations.

In some countries microfinance is used by women in particular. The position of women and their influence on society is strengthened and improved in this way.

Microfinance improves the local development in a meaningful way and impacts national economies. Investments in microfinance change the world.

The I-AM Vision Microfinance received the PAIF Data Smart 2023 seal of approval on behalf of Tameo as a thank you and recognition for its participation in the Private Asset Impact Fund (PAIF) report.

Tameo Impact Fund Solutions SA is a Swiss impact investing specialist that supports the financial industry with independent expert solutions. Tameo guides investment funds, managers and investors through the entire impact investment process.

The report is the result of a four-month survey conducted by Tameo on private asset impact funds (PAIFs) with a focus on developing countries. The market surveyed consists of all investment companies run by specialist impact fund managers with a development focus that invest more than 50% of their tangible assets in private debt or private equity instruments and in emerging and frontier markets.

I-AM is proud to have contributed to the transparency of impact investing through its engagement!

The I-AM Vision Microfinance, Impact Asset Management's microfinance fund, was again awarded the ECOreporter sustainability seal in 2024 by ECOreporter, a German magazine for sustainable investments. Based on strict sustainability criteria specially developed by ECOreporter, only 17 funds were awarded the sustainability seal. Four of these 17 funds are microfinance funds. This confirms the fundamentally high impact that this special segment has.

Along with the FNG seal of the Forum Nachhaltige Geldanlagen e. V. and the Austrian Eco-label, the ECOreporter sustainability seal is one of the established seals for ethical-ecological investments in Germany. Only providers whose core business is sustainable and

who fully meet their own sustainability promises are awarded the seal. The seal is awarded for one year at a time.

Der I-AM Vision Microfinance erhielt zum wiederholten Mal das international anerkannte LuxFLAG-Label. LuxFLAG ist eine unabhängige Vereinigung ohne Gewinnzweck, die 2006 in Luxemburg ins Leben gerufen wurde. Ziel der Agentur ist es, Investmentfonds, die im Mikrofinanzbereich tätig sind, mit einem spezifischen Label auszuzeichnen, das nach klar definierten und veröffentlichten Kriterien vergeben wird. Das LuxFlag-Label garantiert Investoren, dass ihre Gelder auch tatsächlich in Mikrofinanz fließen. Um das LuxFlag-Label zu erhalten, müssen Investmentfonds transparent sein, sich von einer nationalen Behörde beaufsichtigen

lassen und mindestens ein Viertel ihres Mikrofinanz-Portfolios in Mikrofinanzinstitutionen investieren, die von einer Mikrofinanz-

Ratingagentur bewertet werden, die wiederum von LuxFLAG anerkannt ist.

Impact Asset Management GmbH is a member of the Forum Nachhaltiger Geldanlagen (FNG), the professional association for sustainable investments in Germany, Austria, Liechtenstein and Switzerland. "Sustainable investments" is the general term for sustainable, responsible, ethical, social, ecological investments and all other investment processes that include the influence of ESG (environmental, social and governance) criteria in their financial analysis.

Impact Asset Management GmbH is one of the first signatories of the UN PRI in Austria. The six "Principles for Responsible Investment" (UN PRI) introduced by the UN in 2006 are principles for responsible investment. They require investors and asset managers to comply with financial market-relevant environmental, social and governance criteria (ESG guidelines) in their investment activities.

Financial & Social Return

Advantages for investors:

Fair & social return

- Your investment empowers the working poor and their families to build a sustainable and successful existence.

- The targeted returns are Euribor +2% (VMF Hard Currency) and Libor +6% (VMF Local Currency) respectively.

Low default risk

- The payback ratio of micro-entrepreneurs is 96-98%.

Risk minimisation

- Broad diversification of your investment over many countries, institutions and micro-entrepreneurs

- Uncorrelated with traditional asset classes.

- Short maturities of micro credits (6 months - 3 years)

Short duration

Advantages for micro-entrepreneurs:

Regulated access to money

Improved living circumstances

- Food, health, medical care

Access to education for children

- which has a sustainable effect on the future generations.

Strengthening of the position of entrepreneurial active women in society

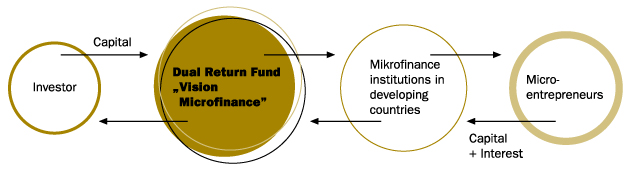

Path of the money

Your investment in „Vision Microfinance“ is circulated to microfinance institutions (MFIs) in the whole world in the form of direct loans. The MFIs, which are carefully selected by us, then hand out micro credits to micro-entrepreneurs. Consequently, they can begin to become economically active with this support.

Micro-entrepreneurs are obliged to pay back the micro credit to the MFIs in time and with interest. Likewise, they must pay back the loan with interest to the fund which is thereby able to offer a solid return for the investor.