Impact Asset Management GmbH

is a leading sustainable asset management company in the German speaking region, which is specialized in asset allocation, analysis and management of impact and sustainable investments. The I-AM team consists of 28 employees.

The investment policy pursues the goal of contributing to the achievement of the UN Sustainable Development Goals through the investment strategy in ESG-compliant securities, impact investment via microfinance and a responsible investment approach. Our investment objective is to generate social, environmental and financial returns as a "triple bottom line" asset manager. Collaborations complement our investment processes and promote the exchange of knowledge at an international level.

The aim of all products is continuous capital growth but with a focus on security and risk minimisation. In rising markets the focus is on performance optimisation. In falling markets the focus is on active risk management in order to protect the consigned assets from heavy losses.

The business focus is on institutional clients and high net worth individuals. Our goal is to increase our customer base in close collaboration with banks, online businesses and distributors and to expand into new markets in the coming years.

CSR

Corporate Social Responsibilty to us implies the taking of responsibilty in our activities as an asset management company towards our clients, partners and colleagues.

Thanks to this, Impact Asset Management GmbH is included in the leading top 50 impact investment fund managers by the American nonprofit financial services company ImpactAssets ( www.impactassets.org ) in 2011. ImpactAssets 50 is a global database which only selects the leading top 50 impact fund managers. The selection criteria were based not only on the financial return of the investment products but also on their social and environmental return. Impact Asset Management convinced at portfolio level due to its social impact and at company level due to its Corporate Social Responsibility.

Impact Asset Management is amongst the first signatories of the UN PRI in Austria. In 2006, the UN introduced six "Principles for Responsible Investment" (UN PRI). By signing these, investors and asset managers agree to commit themselves to environmental, social and governance issues in their investment activities.

The investment policy pursues the mission of contributing to the UN Sustainable Development Goals through an investment strategy in ESG screened assets, impact investments via microfinance and a responsible investment approach. Our investment objective is to generate social, environmental and financial return as a triple bottom line asset manager. Cooperations complement our investment processes and foster knowledge sharing on an international level.

To Impact Asset Management it is of utmost concern to not only provide specialised absolute return products but also to develop financial products which offer selfsupporting economic solutions, particularly to the underpriviliged. Hence, in 2006, the year Impact Asset Management was founded, the first microfinance fund, I-AM Vision Microfinance, was launched. Vision Microfinance offers loans to microfinance institutions, which in return offer loans to micro entrepreneurs.

Meanwhile, for the past years, Vision Microfinance has offered people in developing countries an opportunity to escape poverty. Up to the present day, two microfinance funds have distributed 1,422 promissory notes worth over 2.60 billion USD to 341 different microfinance institutions in 69 countries. This meaningful and sustainable help for self-help permits families access to food, medical care and education for their children. Thanks to our investors, Vision Microfinance has offered 2.4 million people a future with perspective.

Management Team

Günther Kastner

is founder, Managing Director and CEO of Impact Asset Management GmbH. Before founding the company he was chairman and Head of Portfolio Management (CIO) of Vienna Portfolio Management AG. He has more than 28 years of experience in asset management.

Daniel Feix

is Managing Director of Impact Asset Management GmbH.

He has been with the company since 2002, starting his career as a fund manager, later taking on the role of Head of Portfolio Management and has many years of expertise in the international financial markets. Daniel Feix is also responsible for relationship management of institutional clients.

Thomas Kerle

is Managing Director and Chief Operations Officer of Impact Asset Management GmbH. After 13 years in the financial services industry and several years in IT consulting, he became Head of IT in 2017.

Magda Ujwary

is Managing Director and Chief Operations Officer of Impact Asset Management GmbH. She has many years of management experience in the Austrian investment fund industry and a deep understanding of strategies and processes.

Sales & Fund Management Team

Christoph Eckart

Senior Fund Manager, Microfinance

Birgit Havlik

Fund Manager, Microfinance

Laurent Bauer

Financial Analyst, Microfinance

Andreas Böger

Head of Sustainability

Dr. Christian Pail

Senior Fund Manager, ESG

Nicole Sperch

Senior Fund Manager, ESG

Maria Spanner

Senior Fund Manager, ESG

David Stadlmayr

Fund Manager, ESG

Thomas Wihan

Senior Fund Manager, Global Macro

Marko Milovanovic

Senior Risk Manager, Global MacroHistory

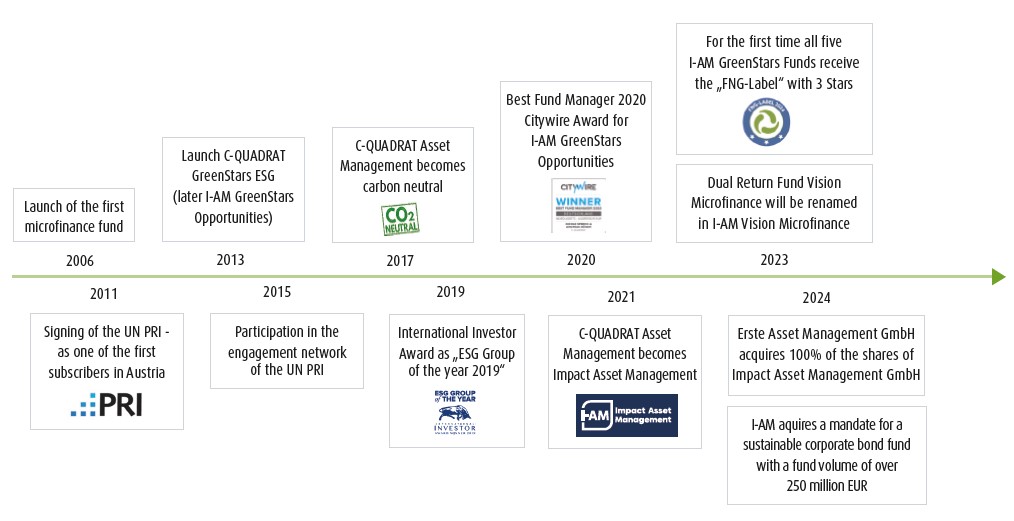

2024

Assets under management amount to EUR 4.45 billion at the end of 2024.

Erste Asset Management GmbH acquires 100 per cent of the shares of Impact Asset Management GmbH.

Impact Asset Management aquires a mandate for a sustainable corporate bond fund with a fund volume of over EUR 250 million and recruits the responsible fund manager.

All five of the I-AM GreenStars funds are again awarded three stars by the Forum Nachhaltige Geldanlagen e.V. (FNG), the highest sustainability award.

Three funds in the I-AM GreenStars family have been awarded the Austrian Eco-label.

The I-AM Vision Microfinance funds are again awarded the LUXflag Microfinance Label.

I-AM Vision Microfinance: Since the fund's inception, more than USD 2.60 billion has been disbursed in the form of 1,414 loans to 341 different MFIs in 69 countries, supporting UN SDG Goals 1, 5 and 8.

2023

Assets under management amount to EUR 3.7 billionat the end of 2023.

For the first time all five of the I-AM GreenStars funds receive three stars from Forum nachhaltige Geldanlagen e.V. (FNG), the highest sustainability award.

I-AM expands its management team to include IT specialist Thomas Kerle. He now acts as Chief Operations Officer.

Patrick Furtwängler joins the German sales team and is appointed Head of Wholesale Sales.

The I-AM GreenStars Opportunities Fund celebrates its 10th anniversary and once again receives the 5-star Morningstar rating.

I-AM Vision Microfinance (formerly Dual Return): Since the fund was launched, more than USD 2.50 billion has been granted to 340 different MFIsin 69 countries in the form of 1,389 loans and supports the UN SDG goals 1, 5 and 8.

2022

Assets under management amount to EUR 3.5 billion at the end of 2022.

Four of the I-AM GreenStars funds receive three stars from the Forum Nachhaltige Geldanlagen e.V. (FNG) and thus the highest sustainability award.

The Dual Return Fund -Vision Microfinance was awarded by the ECOreporter with the ECOreporter Sustainability Seal.

Impact Asset Management becomes a Climate Positive Company in autumn 2022.

Launch of the I-AM Global Macro Convexity Fund in the summer. This follows a discretionary global macro and invests in a variety of different risk factors and asset classes via derivatives. The focus is on convex payoff profiles.

It followed the renaming of the C-QUADRAT GreenStars Funds to I-AM GreenStars Opportunities, I-AM GreenStars European Equities, I-AM GreenStars Absolute Return, I-AM GreenStars Global Equities and I-AM GreenStars Balanced.

Renaming of the ARIQON funds to I-AM AllStars Conservative, I-AM AllStars Balanced and I-AM AllStars Multi Asset.

The Dual Return Fund - Vision Microfinance increases its AuM to 784 million Euro. Since fund launch, more than USD 2.35 billion extended to 333 different MFIs in 69 countries in the form of 1,323 loans, supporting 11 UN SDG targets.

In spring 2022, Impact Asset Management GmbH moves to its new location in 1020 Vienna.

2021

Assets under management amount to 3.4 billion at the end of 2021.

The C-QUADRAT GreenStars ESG receives once more top ratings from the rating agencies Morningstar and Lipper. In addition, 4 C-QUADRAT ESG funds obtained the FNG seal with 2 stars.

The Dual Return Fund - Vision Microfinance increases their AuM to 677 million Euro. Since the launch of the fund, more than USD 2.19 billion has been disbursed to 318 different MFIs in 68 countries in the form of 1,249 loans by supporting 11 UN SDG targets.

As of May 22nd, 2021 the former C-QUADRAT Asset Management GmbH now operates under the name Impact Asset Management GmbH.

2020

Assets under management amount to EUR 3 billionas of the end of 2020.

For the fifth time in the history of Citywire Germany, the best fund managers and fund companies were awarded. In the category Mixed Assets - Dynamic EUR (Mixed Assets – Aggressive EUR), Nicole Sperch and Andreas Böger, managers of the C-QUADRAT GreenStars ESG, won this prestigious award.

The C-QUADRAT GreenStars ESG again receives top ratings from the rating agencies Morningstar and Lipper. In addition, 4 C-QUADRAT ESG funds receive the FNG seal with 2 stars.

In February 2020, ARIQON Asset Management AG was acquired by C-QUADRAT Asset Management GmbH and merged into it as of August 5, 2020. Since then, the ARIQON funds have been managed by C-QUADRAT Asset Management GmbH.

2019

Assets under management amount to 2,80 Mrd. EUR at the end of 2019.

The C-QUADRAT GreenStars ESG has received top ratings several times. Morningstar awards five stars for performance. Lipper classifies the fund as Lipper Leader in the areas of consistent income, costs and total return. The independent research and consulting company MMD Analyse & Advisory GmbH has also awarded the C-QUADRAT GreenStars ESG on Asset Standard (www.assetstandard.com) corresponding top ratings.

2018

Assets under management amount to 2,30 Mrd. EUR at the end of 2018.

The C-QUADRAT GreenStars ESG receives top Morningstar ratings - five stars for performance and four globes for sustainability.

The C-QUADRAT Orient & Occident Fund expands the product portfolio. The aim of the C-QUADRAT Orient & Occident Fund is to benefit from the revival of the Silk Road.

The Dual Return Vision Microfinance Fund is awarded with the “European Advanced SDG Award” in the category “Banking&Insurance & Finance Sector”.

2017

Assets under management amount to 2,40 billion EUR at the end of 2017.

The Dual Return Fund – Vision Microfiance increases in 2017 the AuM to 555 million EUR. Since inception of the fund approx. 1,2 billion USD were disbursed to microfinance institutions and accordingly more than 500.000 micro entrepreneurs were financed.

The LionGlobal C-QUADRAT Asian Bond Fund breaches the fund volume of 100 million USD and increases in value of +15,36% since inception.

2016

Assets under management amount to 1,68 billion EUR at the end of 2016.

The C-QUADRAT Gold & Resources Fund increases in value of 56% in 2016.

The Dual Return Fund – Vision Microfinance I EUR is awarded with the "Alternative Investment Awards" of wealth&finance for "Best Microfinance Fund (Since Inception)".

The Dual Return Fund – Vision Microfinance & Vision Microfinance Local Currency are registered for public sale in Germany.

C-QUADRAT Absolute Return ESG Fund is awarded with the Hedge Fund Award 2016 for "Best Absolute Return Fund – Austria".

The three C-QUADRAT sustainability funds (ESG) are awarded with the FNG quality seal.

2015

Assets under management amount to 1,44 billion EUR at the end of 2015.

Inception of the equity fund LionGlobal China A-Share Fund, managed by Lion Global Investors in Singapore, and agreement to a mandate in coorporation with Stuttgarter Versicherung, the C-QUADRAT Stuttgarter ETF STars aktiv.

C-QUADRAT intensifies the focus on sustainability by expanding the product range with three ESG compliant investment funds.

Change of APM’s company name to C-QUADRAT Asset Management GmbH in March 2015.

2014

Assets under management amount to 1,34 billion EUR at the end of 2014.

Extension of the sustainable product line with the C-QUADRAT Global Quality ESG Bond Fund and the C-QUADRAT Nachhaltigkeit Garant 80.

APM supports the principles of responsible investing and was admitted as a member in the Impact in Motion 15 of the DACH region (DE, AT, CH).

Relocation to the new office premises at Schottenfeldgasse 20, 1070 Vienna.

Vision Microfinance goes Social Media on the platforms Twitter and LinkedIn.

GELD-Magazine awarded the APM Gold & Resources awarded with the "Alternative Investment Award 2013".

C-QUADRAT APM Asian Quality Stocks AMI registered for public distribution in Austria.

2013

Assets under management exceed the billion mark for the first time and amount to 1,11 billion EUR at the end of 2013.

Inception of three funds in cooperation with Stuttgarter Versicherung: C-QUADRAT Stuttgarter BalanceStars aktiv, C-QUADRAT Stuttgarter AllStars aktiv und C-QUADRAT Stuttgarter GreenStars aktiv.

Two new equity funds issued: C-QUADRAT APM Asian Quality Stocks AMI (focus on high-quality Asian consumer brand stocks) and C-QUADRAT Global Quality Stocks Plus (focus on global quality stocks in established markets).

Dual Return Fund – Vision Microfinance reaches fund volume of EUR 100 million for the first time.

APM relocates to C-QUADRAT site at Stubenring 2, 1010 Vienna and takes over C-QUADRAT fund management.

2012

Morningstar awarded the APM Gold & Resources Fund with 5 stars for a period of 5 years.

The two APM microfinance funds - Dual Return Fund Vision Microfinance and Dual Return Fund Vision Microfinance Local Currency - have once again been awarded with the LuxFLAG Microfinance Label.

C-QUADRAT Investment AG becomes the majority shareholder of Absolute Portfolio Management GmbH.

C-QUADRAT APM Absolute Return reaches a new all-time high of 11.68 Euro in mid-August.

The two APM bond funds, the APM Fixed Income Fund and the APM Asian Quality Bond Fund (today C-QUADRAT APM Asian Quality Bond Fund) switch to daily evaluation and trading.

Absolute Portfolio Management becomes a promoter of "Forum für nachhaltige Geldanlagen" and the microfinance web portal "Mikrofinanzwiki".

2011

APM launches the APM Asian Quality Bond Fund, a bond fund of Asian issuers with top ratings, in cooperation with Lion Global Investors Ltd., one of the largest asset managers in Singapore. The fund is registered for public distribution in Austria and Germany.

C-QUADRAT is the new administrator of C-QUADRAT APM Absolute Return, formerly known as APM Global Balanced Fund, and is responsible for sales.

APM is a signatory of the "Principles for Responsible Investment" by the UN (UN PRI). In doing so, APM voluntarily agrees to commit itself to environmental, social and governance issues in its investment activities. Absolute Portfolio Management Ltd. is amongst the first signatories of the UN PRI in Austria.

APM is included in the leading top 50 impact investment fund managers by the nonprofit financial services company ImpactAssets.

Two UCITS compliant AIV Vision Microfinance Certificates, which are registered for public distribution in Germany and Austria, are launched in cooperation with issuer Oaklet. Sustainability funds and products in particular profit from the certificates as they allow straightforward investments in microfinance.

Vision Microfinance is awarded with the internationally recognised Luxflag label for the fourth time.

The APM Gold & Resources Fund is the winner in the category of commodities equity funds gold over three years at the "Geld" magazine`s Alternative Investment Award.

2010

The Dual Return Fund – Vision Microfinance ist made available for public distribution in Austria, the first of its kind in this country.

The APM Global Balanced Fund is awarded the Austrian Fund Prize: Fund of funds, mixed, global, 3rd place, conservative, 5 years.

Launch of the Dual Return Fund – Vision Microfinance Local Currency, the first microfinance fund worldwide, which extends local currency loans to microfinance institutes in developing countries.

2009

Launch of three new funds: a fixed income fund specialised in EUR bonds, APM Fixed Income and two fund of hedge funds, the APM Alternative I and the APM Managed Fuutres.

The APM Global Balanced Fund is awarded the Austrian Fund Prize: Fund of funds, mixed, global, 2nd place, conservative, 5 years

2008

The APM Global Balanced Fund is awarded the Austrian Fund Prize: Category §14 fund of funds, 3rd place, over the 3 and 5 year time-span.

2007

The Precious Metals Equities Fund APM Gold & Resources Fund is launched.

2006

The Absolute Portfolio Management GmbH (today Impact Asset Management GmbH) is formed by spinning off the asset management business from the Vienna Portfolio Management AG in April 2006.

Günther Kastner, before Managing Director and Head of Portfolio Management (CIO) at Vienna Portfolio Management AG and a specialist in the field of Alternative Investments for more than 20 years, assumes the shared management of the company with Mr. Ernst-Ludiwg Drayss, before the long standing Director and Head of Portfolio Management (CIO) at Deutsche Asset Management (institutional portfolio management of the Deutsche Bank Group).

The core businesses at this time are consulting mandates for institutional clients, as well as the management of specialized investment vehicles (Großanlegerfonds and Spezialfonds). The goal of the reorganization is the bundling of expertise in the management of Alternative Investment products, to launch a palette of open-end mutual funds in this area and to establish the brand APM for these products.

The management of the fund APM Global Balanced, founded in the year 2000, is assumed by APM and continues to be managed along Absolute Return principles.

The microfinance fund Dual Return Fund – Vision Microfinance is launched in April.

The APM Global Balanced Fund is awarded the Austrian Fund Prize: Category §14 fund of funds, 3rd place, 3 years.