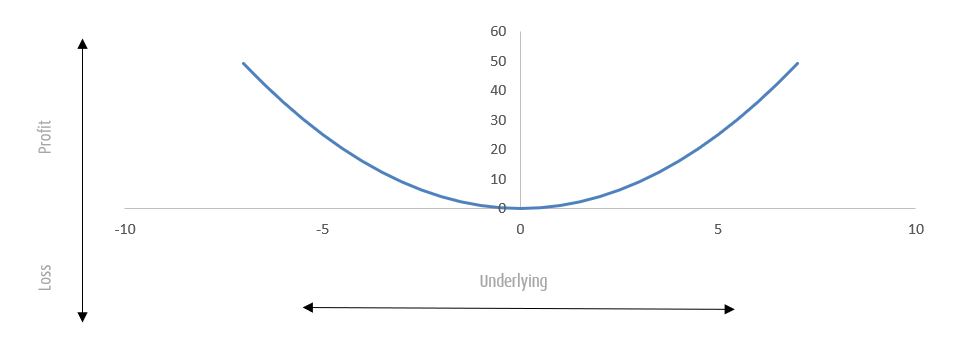

Focus on convex payoff profiles

The I-AM Global Macro Convexity Fund follows a discretionary macro strategy and will invest in a variety of different risk factors and asset classes through derivatives. The focus will be on convex payoff profiles.

"The use of tailor-made derivatives permits risk profiles that should lead to stable performance in turbulent times."

Thomas Wihan, Senior Fund Manager at I-AM

Convex positioning

- Limited loss potential (the invested premium).

- In periods of stable markets, the fund may invest segments of its assets in products that benefit from the passage of time, e.g. currency carry trades that compensate the time decay of options.

- Positioning through long options usually saves the fund from becoming a forced seller during market disruptions.

Focus on three overarching investment objectives

Absolute return - Generating returns regardless of market conditions through a balanced portfolio (balanced "risk on", risk off" and market-neutral positioning).

Low or even negative correlation to traditional assets intended - The broad investment universe (equities, currencies, interest rates, credit as well as their volatilities and correlations) ensures exposure to a large number of risk factors and thus a high degree of diversification.

Risk-reducing potential - By actively taking long volatility positions, the fund can offer a portfolio-stabilising effect in asset allocation and thus replace different hedging approaches at low cost.

"Risk on - Risk off" and market-neutral trades

Asymmetric risk profiles, such as the purchase of options, allow the fund to profit in the event of large market movements, with risk limited to the option premium. This makes it possible to generate returns even in uncertain times, as the positions benefit disproportionately from their sensitivity to the increase in volatility and provide a stabilisation of performance. On the other hand, interesting long-term investment opportunities, such as yield curve steepening or high-yield currencies, are added to the portfolio as strategic positions. These should provide a base return.

In the portfolio construction, attention is paid to balance - "risk on", "risk off" and market-neutral positions should balance each other out. Tail risk positions are added to the portfolio to achieve the lowest possible correlation to traditional asset classes. The aim of this approach is to absorb the losses of "risk on" positions in the event of market turbulence. This structural long volatility positioning should work particularly well in times of market disruption and is applied across all asset classes.

"The fund strategy requires a risk management approach at the individual position level. This requires an understanding of the individual risk drivers and their evolution over time."

Marko Milovanovic, Senior Risk Manager at I-AM

Factsheet & Market Commentary

The I-AM Global Macro Convexity Fund invests globally in different asset classes according to a discretionary approach that takes advantage of flexibility and fast reaction time within well-defined risk management limits. The strategy focuses on opportunistic trading (i.e. positions are only taken when risk factors appear favourably valued by historical standards). In portfolio construction, attention is paid to balance - "risk on", "risk off" and market-neutral positions are balanced. The products used include traditional instruments such as equities and bonds as well as exchange-traded and OTC-traded derivatives, with a focus on convexity. Thus, predominantly asymmetrical payoff profiles are used, which offer appealing return expectations with basically manageable risk.

Fund Information

The basis for the purchase of investment units is the current sales prospectus, the key investor information document ("PRIIP") as well as the annual report and, if older than eight months, the semi-annual report. These documents are available to interested parties free of charge in German at the Investment Company LRI Invest S.A., 9A Rue Gabriel Lippermann,5365 Schuttrange, Luxembourg, and on the internet at www.lri-invest.lu.